PRE-REQUISITES

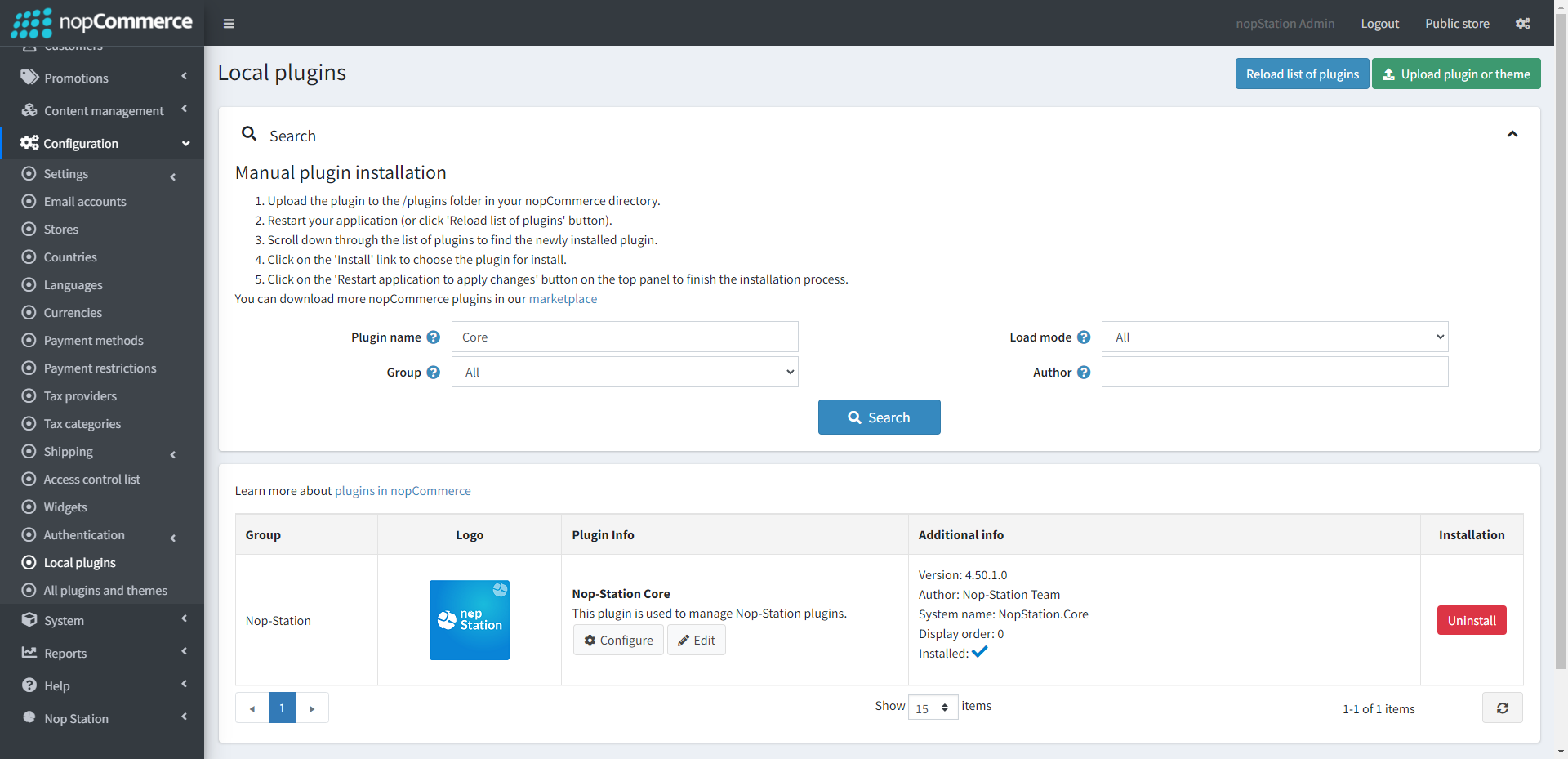

- The plugin requires you to install the Nop-Station Core plugin first.

INSTALLATION

- Download the Multiple Tax Plugin from our store https://nop-station.com/customer/downloadableproducts

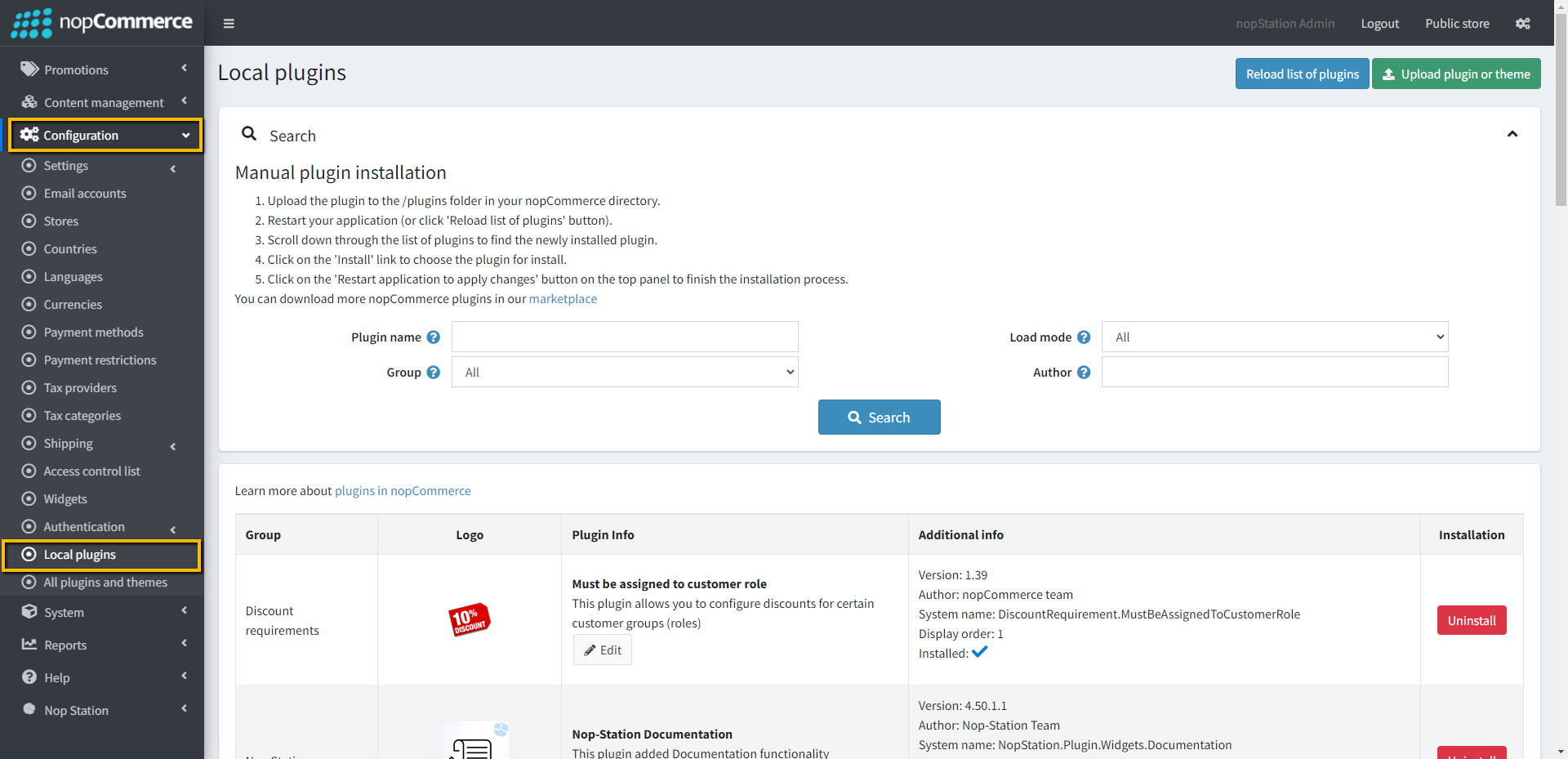

- Go to Administration → Configuration → Local plugins

- Upload the NopStation.MultipleTax zip file using the "Upload plugin or theme" button

- Go to Administration, reload the 'list of plugins'. Install 'Nop-Station Core' Plugin first and then install 'Manual (Multiple Taxes)'

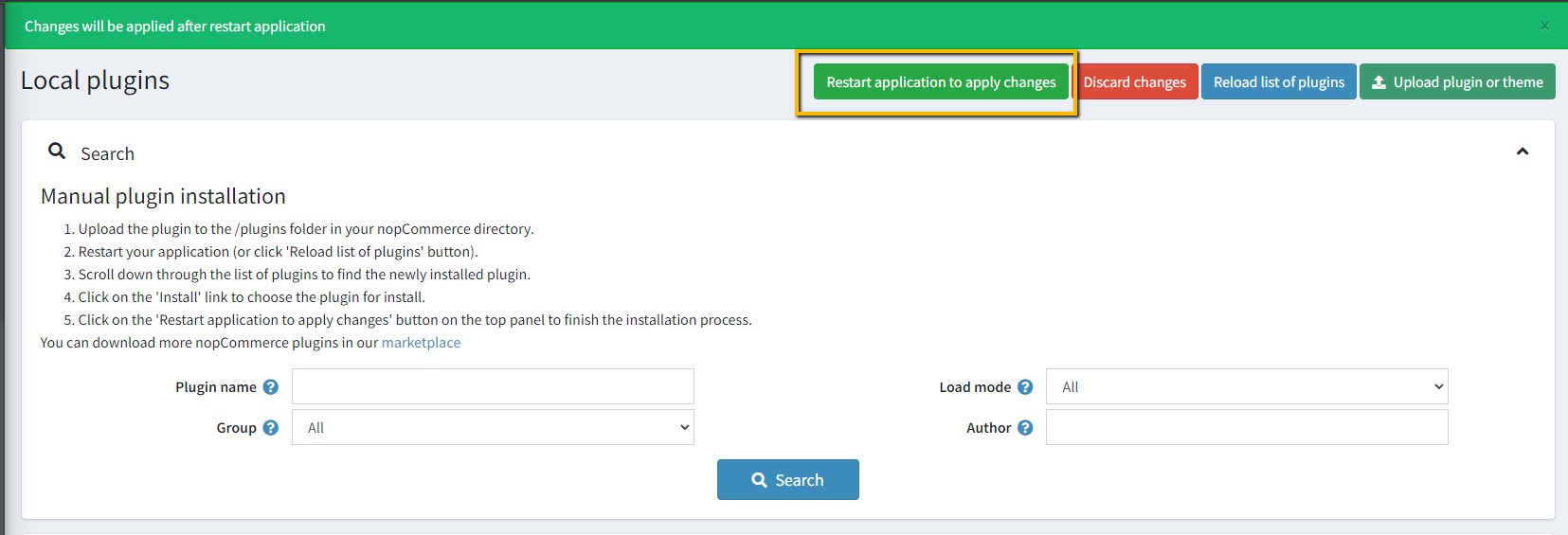

- To make the plugins functional, restart the application

- Enable the plugin with 'Edit' option and Configure it

CONFIGURATION

- Go to Admin → Nop Station → Plugins → Multiple Tax → Configuration

- From here you can enable or disable this plugin in your store

- In configuration there are two options. Either you can configure by fixed rate or you can configure by country

- Fixed Rate: In fixed rate there are five categories. You need to put the tax rate into these tax categories. You can update the tax rate at any time

- Specific Country: In the country tax rate you need to select a specific country, state/province, and zip code

- You also need to specify the product category

- There are three tax rate options(PST, GST, HST). You can put the percentage according to your requirements

- You can edit or delete the tax rates at any time